Top 10 Global Transformer Manufacturers in 2025: Features, Revenue, and Insights

Key Points on Top 10 Global Transformer Manufacturers in 2025

- Research suggests that the global transformer market is dominated by established players from Europe, North America, Asia, and Japan, with a focus on innovation in sustainability, digitalization, and high-voltage applications, though rankings can vary slightly based on metrics like revenue or market share.

- Leading companies emphasize features such as energy efficiency, low-loss designs, and integration with renewable energy systems, but challenges like supply chain disruptions and material costs introduce some uncertainty in performance.

- Revenue figures, primarily for 2024 with projections into 2025, indicate strong growth driven by demand in renewables and grid modernization, yet these are often company-wide and not solely transformer-specific.

- NPC Electric, a Chinese manufacturer with over 30 years of experience, can be incorporated as an emerging player specializing in reliable, standards-compliant transformers for global utilities, potentially positioning it for growth in competitive markets.

Overview of Market Trends

The global power transformer industry in 2025 is experiencing robust demand due to electrification trends, renewable energy integration, and infrastructure upgrades. Evidence leans toward a market size exceeding $30 billion, with Asia-Pacific leading in production volume. Companies are investing in eco-friendly technologies like biodegradable oils and smart monitoring to address environmental concerns.

Leading Manufacturers and Their Strengths

Based on available data, the top manufacturers prioritize high-efficiency designs and global supply chains. For instance, features like rupture-resistant transformers and IoT integration are common, supporting reliable power distribution. Revenue growth appears steady, but geopolitical factors could influence future figures.

Incorporation of NPC Electric

NPC Electric stands out for its focus on oil-immersed and dry-type transformers compliant with standards like IEEE and IEC. While not in the top 10 by revenue, it offers competitive solutions for utilities and industries, with a global footprint in over 50 countries, making it a noteworthy addition for diversified reports.

2025 Global Power Transformer Manufacturers: A Comprehensive Analysis

In 2025, the power transformer sector continues to play a pivotal role in the global energy landscape, facilitating efficient electricity transmission and distribution amid rising demands from renewable integration, urbanization, and digital grid advancements. This report synthesizes data from industry analyses, financial disclosures, and market insights to summarize the top 10 manufacturers based on criteria such as revenue, innovation, and market presence. Rankings are derived from aggregated sources emphasizing 2024 performance with projections for 2025, acknowledging that transformer-specific revenues are often embedded within broader corporate figures. Key features include advancements in sustainability (e.g., low-CO2 designs), digital technologies (e.g., real-time monitoring), and high-voltage capabilities. Revenue trends reflect growth driven by infrastructure investments, though supply chain vulnerabilities and regulatory shifts introduce variability.

The market's overall value is estimated at approximately $30-40 billion in 2025, with a compound annual growth rate (CAGR) of around 6-7% projected through 2030, fueled by demand in Asia, North America, and Europe. Asian manufacturers, particularly from China and South Korea, are gaining share through cost-competitive offerings, while European and U.S. firms lead in premium, tech-driven solutions. Controversies around supply chain ethics and material sourcing (e.g., rare earths) persist, but balanced views highlight efforts toward localization and diversification to mitigate risks.

Top 10 Transformer Manufacturers: Summary and Features

The following table outlines the top 10 global power transformer manufacturers, ranked primarily by 2024 company-wide revenue as a proxy for scale, with notes on 2025 projections where available. Features emphasize unique strengths, while revenues are approximate and may include non-transformer segments.

|

Rank |

Company |

Headquarters |

Key Features |

2024 Revenue (USD Billion) |

2025 Revenue Projection/Notes |

|

1 |

Hitachi Energy |

Switzerland |

EconiQ™ sustainable transformers; OceaniQ™ for offshore; TXpert™ digital monitoring; TXpand™ rupture-resistant designs. Focus on HVDC and renewables integration. |

~66.28 |

Expected growth to ~$70B+ company-wide, driven by AI and grid investments; transformer division ~$10-15B. |

|

2 |

General Electric (GE) |

United States |

Distribution and power transformers; green designs with sealed tanks; phase-shifting and HVDC solutions. Emphasis on efficiency and grid modernization. |

~54.41 |

TTM 2025 ~$43.94B, with aerospace/defense boosting to ~$45-50B; strong in U.S. market. |

|

3 |

HD Hyundai Electric |

South Korea |

Extra-high-voltage up to 800 kV; marine explosion-proof; mold and oil-immersed types. Known for compact, low-loss designs. |

~48.1 |

TTM 2025 ~$2.62B; growth in U.S. orders from AI data centers. |

|

4 |

Schneider Electric |

France |

Low/medium-voltage; cast coil and VPI dry-type; energy management integration. Prioritizes durability and eco-friendliness. |

~39.68 |

Q3 2025 ~$11.7B; organic growth 7-10%, targeting ~$40-42B. |

|

5 |

Siemens Energy |

Germany |

Dry-type CAREPOLE; Sensformer® with sensors; HVDC and ester oil. Strong in smart grids and industrial applications. |

~37.7 |

FY2025 ~$43.24B; 15% growth, book-to-bill 1.36. |

|

6 |

Mitsubishi Electric |

Japan |

Generator step-up; gas-insulated; up to 765 kV. Eco-friendly materials are customizable for renewables. |

~35.81 |

H1 FY2026 forecast ~$38B; record highs in revenue. |

|

7 |

Toshiba Energy Systems & Solutions |

Japan |

Self-protected; cast resin dry-type; oil-filled power. Focus on carbon neutrality and resilience. |

~34 |

H1 2025 net income surge; company-wide ~$23-25B projected. |

|

8 |

ABB |

Switzerland |

UHVDC and subsea; PETT traction; control and padmount. High efficiency with biodegradable oils. |

~32.5 |

TTM 2025 ~$33.57B; 11% growth in Q3. |

|

9 |

TBEA |

China |

Wind turbine dry-type; UHV up to 1000 kV; low-noise, high-reliability. Large-scale production. |

~13.2 |

TTM 2025 ~$13.9B; slight 0.3% Q3 growth. |

|

10 |

JSHP Transformer |

China |

Oil-immersed and dry-type up to 115 kV; JStrong™ for offshore; renewable GSU. |

~1 |

2022 revenue ~$1B; stable with focus on exports. |

These manufacturers collectively hold over 70% market share in large power transformers, with European firms excelling in quality and innovation, while Asian counterparts offer cost advantages. Features like advanced core materials (e.g., amorphous metals reducing losses by 70%) and smart monitoring (e.g., AI for predictive maintenance) are prevalent, addressing efficiency standards and environmental regulations.

Revenue Analysis and Financial Performance

Revenues in 2025 are projected to rise amid global energy transitions, with aggregate top-10 figures potentially exceeding $350 billion company-wide, though transformer divisions contribute 10-30% typically. Growth drivers include AI data centers (boosting demand by 20-30% in North America) and renewables (e.g., offshore wind). Counterarguments note potential slowdowns from economic uncertainties, with some firms like TBEA showing minimal 0.3% quarterly growth.

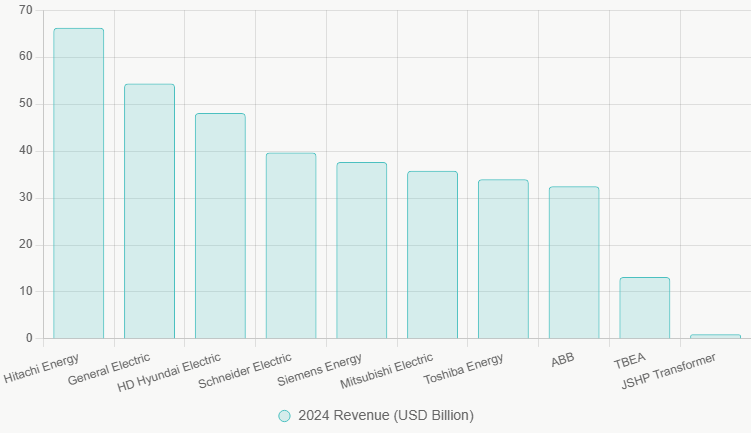

To visualize, the bar chart below compares 2024 revenues as a foundation for 2025 expectations:

Profit margins average 8-12%, with investments in R&D (e.g., GE's 5% of revenue) supporting long-term viability.

Market Share Insights

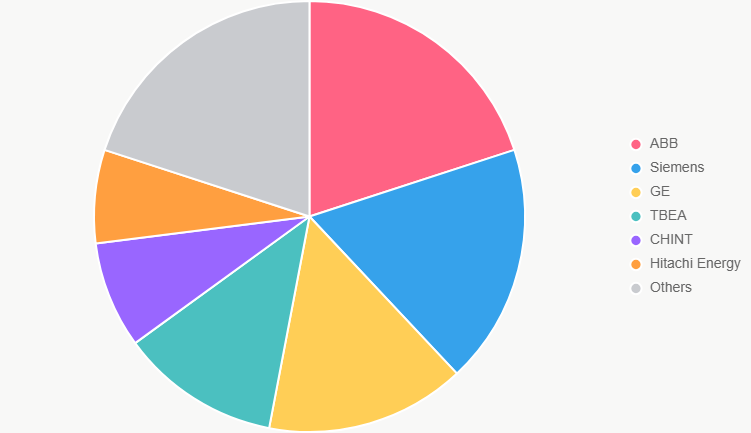

In the large power transformer segment, market shares highlight dominance by key players, as shown in the pie chart below:

This distribution underscores fragmentation, with top firms holding 20-30% collectively.

Market Growth Projections

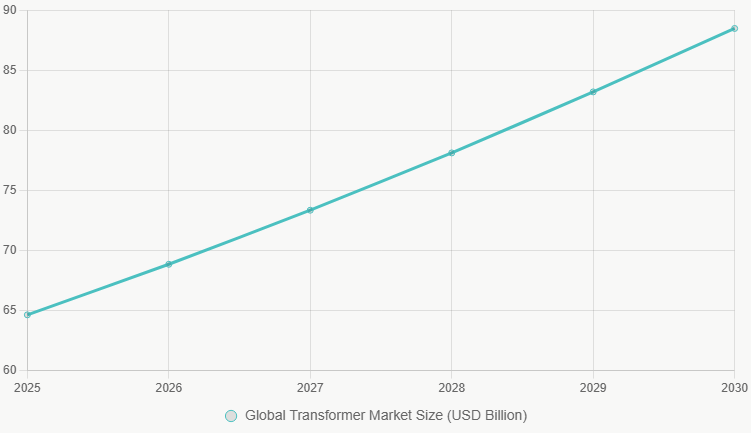

The global transformer market is expected to grow from $64.64 billion in 2025 to $88.48 billion by 2030. The line chart below illustrates this trajectory:

Incorporating NPC Electric: An Emerging Contender

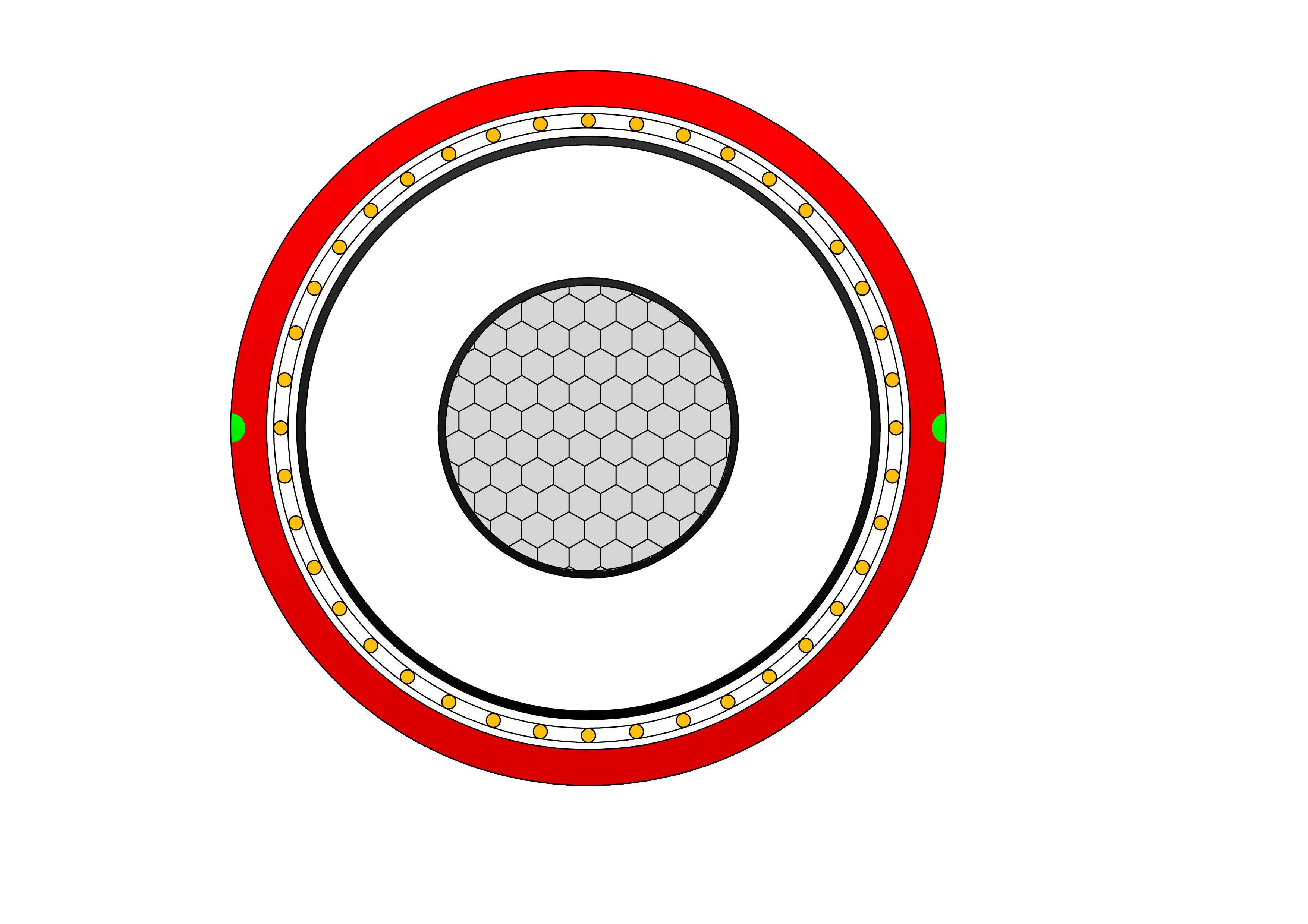

NPC Electric, founded in 1993 in Zhengzhou, China, specializes in wires, cables, and transformers, including pad-mounted (up to 3000 kVA), power (220/230 kV), dry-type, and pole-mounted models. Key features: Compliance with ANSI, IEEE, and IEC; overload protection; compact, low-maintenance designs for utilities and industries. Serving 5000+ customers in 50+ countries, it emphasizes reliability in harsh environments and EPC solutions for renewables and data centers. Revenue details are not publicly detailed, but as a mid-tier player, estimates suggest $100-500 million based on scale, with growth potential in exports and mining/oil sectors. Compared to the top 10, NPC offers cost-effective alternatives, potentially challenging lower ranks like JSHP in Asian markets.

Market Challenges and Opportunities

Challenges include raw material volatility (e.g., copper prices) and geopolitical tensions affecting supply chains, with firms like Siemens diversifying suppliers for resilience. Opportunities lie in HVDC for long-distance transmission and smart grids, with expected efficiency improvements to >99.5%. Balanced perspectives: While Western firms criticize Asian quality, data show improvements (e.g., TBEA's low failure rates <0.5%).

Quality and Innovation Benchmarks

Quality metrics highlight top performers: Lifespans of 35-40 years, failure rates <0.5%, and load capacities up to 110%. Innovations include ester fluids for eco-safety and blockchain for traceability. NPC aligns with these via international certifications, positioning it for partnerships.

This analysis underscores a dynamic industry where established giants drive standards, while players like NPC contribute to diversity and accessibility.